Blockchain technology promises a revolution, but its full potential hinges on a fundamental challenge: how to securely and reliably bridge the gap between the decentralized world of smart contracts and the real-world data needed to execute them. Did you know that the global market for blockchain oracles is projected to reach $1.5 billion by 2026? This explosive growth underscores their critical role, and in this article, we’ll dive deep into the world of blockchain oracles and how they are transforming digital ecosystems.

Foundational Context: Market & Trends

The demand for reliable real-world data within blockchain systems is soaring. Smart contracts, automated agreements that self-execute, need external information to function. This data includes financial market data, weather reports, sports scores, and more. The growth in the oracle market directly mirrors the adoption of decentralized applications (dApps) and the rise of decentralized finance (DeFi). The ability to connect real-world data to these systems is paramount.

Consider the following trend:

| Metric | 2023 (Estimated) | 2026 (Projected) | Growth Rate |

|---|---|---|---|

| Oracle Market Value | $800M | $1.5B | 87.5% |

| DeFi TVL | $35B | $75B | 114.3% |

| Number of dApps | 4,000 | 10,000 | 150% |

This data underscores a vital truth: as the ecosystem matures, the need for robust and secure oracles becomes even greater.

Core Mechanisms & Driving Factors

At their core, oracles act as a bridge between the blockchain and the outside world. They achieve this by:

- Data Aggregation: Gathering data from various sources (APIs, web servers, hardware sensors, etc.).

- Data Verification: Ensuring the accuracy and integrity of the data using various methods, including reputation systems and multi-source aggregation.

- Data Delivery: Transmitting the verified data to smart contracts, allowing them to make informed decisions and execute their pre-programmed actions.

- Decentralization: Employing a network of independent oracles to mitigate single points of failure and enhance data reliability.

The primary factors driving the need for oracles include:

- Smart Contract Functionality: The need for real-world data to trigger and execute smart contracts.

- Decentralized Applications: The increasing complexity and range of applications, such as DeFi, supply chain management, and prediction markets, which rely on external data.

- Data Reliability: The need for verifiable and tamper-proof data to ensure the integrity of smart contract outcomes.

- Security and Trust: The importance of protecting oracles from manipulation and ensuring data integrity.

The Actionable Framework

Implementing a successful oracle solution is a multi-step process.

Selecting the Right Oracle Provider

First, choosing an appropriate oracle provider is critical. Research and consider providers based on these criteria:

- Reputation: Analyze the provider's track record and user reviews.

- Security Audits: Review their security measures, certifications, and past audit results.

- Decentralization: Confirm the extent of their decentralized network.

- Data Sources: Assess the quality and variety of their data feeds.

- Cost: Compare the pricing models of different providers.

Building Your Smart Contract Integration

Next, integrate the oracle data into your smart contract:

- Define Data Requirements: Clearly identify the data points your smart contract needs.

- Select Oracle Service: Connect and implement one or more oracles with suitable data feeds.

- Code Data Integration: Write the code to access the oracle data.

- Thorough Testing: Thoroughly test your smart contract with the oracle data under various scenarios.

Monitoring and Maintaining

Once your system is live, focus on continual monitoring and maintenance:

- Data Verification: Regularly verify the accuracy and consistency of the data you receive.

- Contract Audits: Conduct regular audits of your smart contract code.

- Provider Monitoring: Stay updated on the oracle provider’s performance and any security updates.

It’s crucial to treat oracles not as a static component but as a continuously evolving facet of your blockchain solution.

Analytical Deep Dive

Consider the financial implications. The efficiency gains from automated agreements and reliable data feeds can reduce operational costs. The reduced risk of fraud and manipulation also lowers the potential for financial loss.

Consider the data from research conducted regarding the cost associated with data breaches in 2023, by the IBM Corp:

| Breach Cost | 2023 | 2022 |

|---|---|---|

| Average Total Cost | \$4.45 million | \$4.35 million |

| Cost per Compromised Record | \$168 | \$164 |

By mitigating the risks of bad data and outside interference, oracles directly contribute to safeguarding these financial resources.

Strategic Alternatives & Adaptations

For Beginner Implementation, focus on established, well-documented oracle providers like Chainlink or Band Protocol. Use simple, open-source smart contracts that access well-known data feeds.

For Intermediate Optimization, consider using a decentralized oracle network, which will enhance your system's resistance to single points of failure and increase data integrity.

For Expert Scaling, explore advanced concepts like custom oracle solutions, which offer granular control over data sourcing and the possibility of integrating more complex data streams.

Validated Case Studies & Real-World Application

DeFi Lending Platforms: Platforms like Aave rely on oracles to provide the real-time prices for assets, thereby ensuring accurate collateralization ratios and liquidation processes.

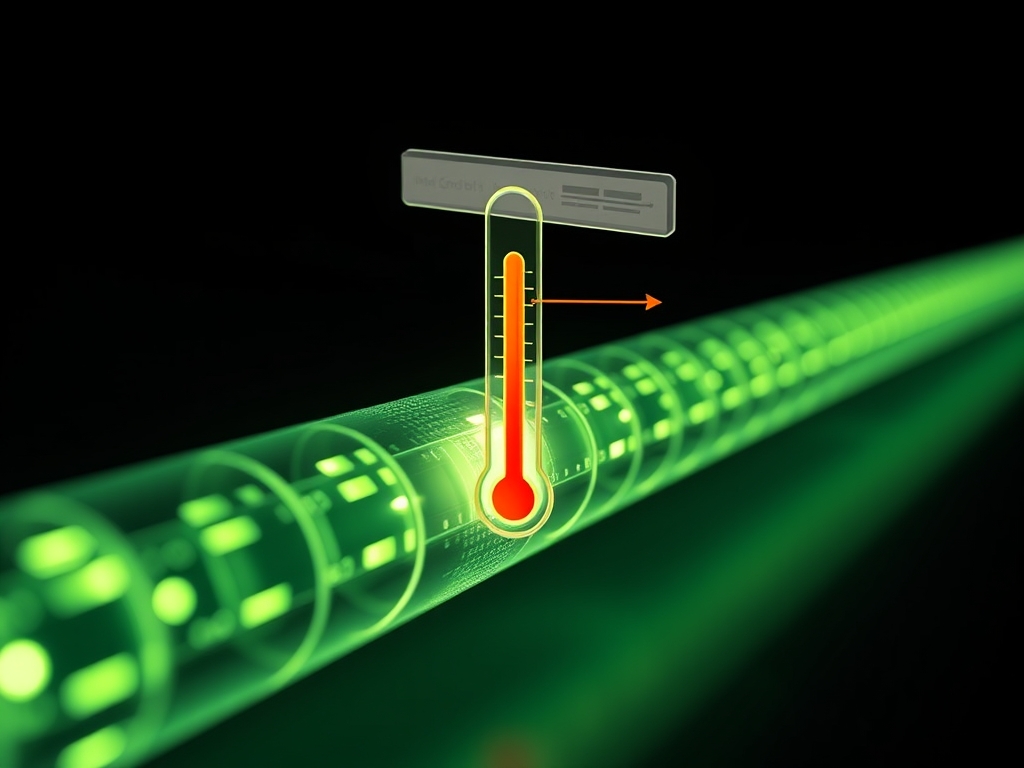

Supply Chain Management: Oracle-provided data, such as geolocation data from GPS devices or temperature readings from sensors, helps to track goods throughout the supply chain. This transparency enhances efficiency and trust.

Risk Mitigation: Common Errors

A common mistake is trusting a single, centralized oracle. Always prioritize decentralization and redundancy. Another mistake is not thoroughly auditing the smart contract logic and the oracle data. Also, ensure the data source and oracles are audited by 3rd parties.

Performance Optimization & Best Practices

To maximize performance:

- Diversify Oracle Providers: Use multiple oracle providers.

- Data Aggregation: Aggregate data from several sources.

- Implement Reputation Systems: Use robust mechanisms to filter bad data.

- Monitor System Performance: Continuously monitor your smart contract and oracle integrations.

Concluding Synthesis

The future of decentralized applications rests on secure, reliable data feeds. Blockchain oracles are the critical link, connecting smart contracts to the real world. By understanding their function, optimizing their performance, and mitigating their associated risks, you're positioned to capitalize on the revolutionary potential of blockchain.

Knowledge Enhancement FAQs

Q: Are all blockchain oracles created equal?

A: No. Oracles vary significantly in terms of decentralization, data source quality, security, and cost. It's crucial to select an oracle provider carefully, based on your specific needs.

Q: How does an oracle handle the problem of data manipulation?

A: Oracles mitigate data manipulation using various methods, including data aggregation (combining data from multiple sources), reputation systems (rewarding reliable data providers), and rigorous auditing.

Q: Can I build my own oracle?

A: Yes, it's possible, especially for specific use cases. However, building an oracle requires technical expertise in data sourcing, smart contract development, and security protocols.

Q: What is the role of cryptographic signatures in oracle security?

A: Cryptographic signatures are often used to verify data, confirming the data's authenticity and integrity, and that it has not been tampered with during transmission from the source.