The future of business is evolving, and it’s evolving rapidly. Consider this: can traditional corporate structures truly compete in a world that increasingly values transparency, community, and decentralized control? The answer, according to many forward-thinking entrepreneurs and technologists, lies in Decentralized Autonomous Organizations (DAOs). DAOs are not just a trend; they represent a fundamental shift in how we think about ownership, governance, and value creation in the digital age.

Foundational Context: Market & Trends

The market for DAOs is nascent but experiencing explosive growth. According to recent research, the total value locked (TVL) within DAO treasuries has surged by over 400% in the last two years, reflecting a growing level of investor confidence and adoption. While precise projections vary, experts forecast continued expansion, driven by advancements in blockchain technology, the rise of Web3, and a growing desire for more equitable and transparent governance models.

| Trend | Impact |

|---|---|

| Increased Blockchain Adoption | Drives the foundational infrastructure for DAOs |

| Web3 Development | Creates demand for decentralized solutions and community-driven platforms |

| Growing Demand for Transparent Governance | Fosters trust and participation |

| DeFi Innovation | Facilitates DAO financial operations, providing utility and growth potential |

This growth trajectory suggests that understanding DAOs is not merely an academic exercise; it's a critical skill for anyone looking to navigate the future of business.

Core Mechanisms & Driving Factors

At their core, DAOs operate on several fundamental principles:

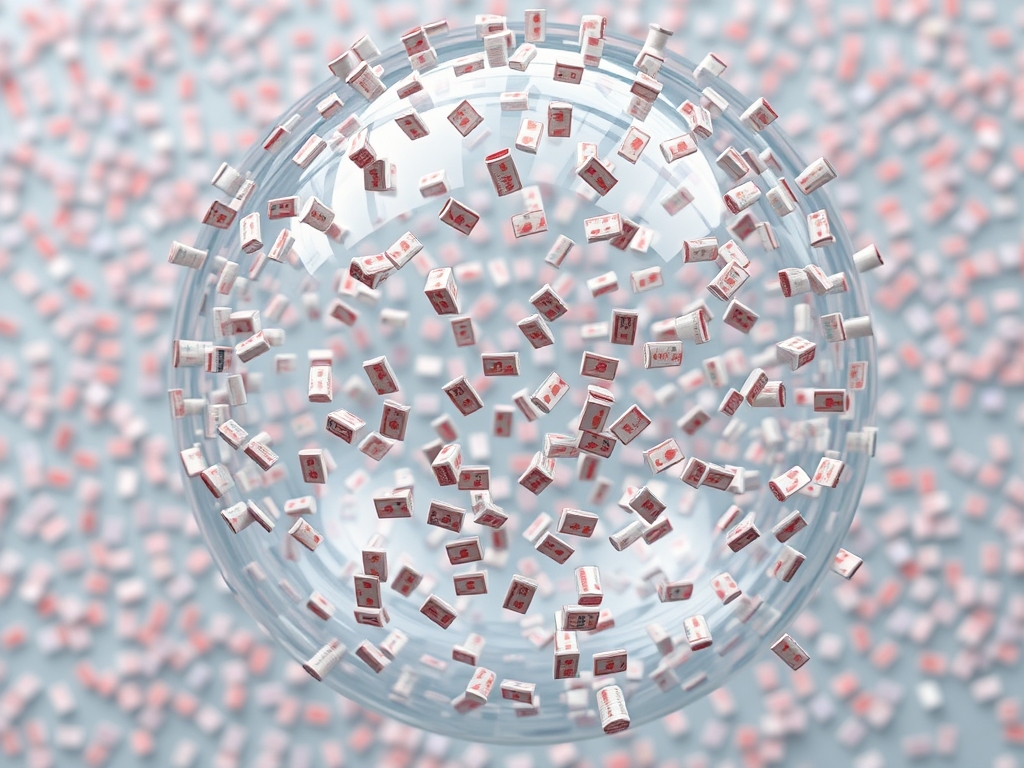

- Decentralization: DAOs are not controlled by a single entity. Decision-making power is distributed among members, often through a voting mechanism tied to token ownership.

- Automation: DAOs utilize smart contracts – self-executing code that resides on a blockchain – to automate processes and enforce rules. This reduces the need for intermediaries and minimizes human error.

- Transparency: All transactions and decisions within a DAO are typically recorded on a public blockchain, ensuring complete transparency and auditability.

- Community Governance: Members of the DAO collectively make decisions through proposals, voting, and shared governance policies.

- Tokenization: DAOs often issue their own tokens, which can be used for voting, accessing services, and incentivizing participation.

These elements, working in concert, enable DAOs to achieve a level of trust, efficiency, and community engagement that is often unattainable in traditional organizational structures.

The Actionable Framework

Creating a DAO requires a strategic and methodical approach. Here's a simplified step-by-step framework:

Define Your Purpose

What problem are you solving? What value are you providing to the community? Clearly define the mission and objectives of your DAO.

Choose Your Technology Stack

Select the blockchain platform (Ethereum, Solana, etc.), smart contract tools, and governance platforms that best suit your needs.

Design the Governance Model

How will decisions be made? What voting mechanisms will you use? Determine the tokenomics (how tokens will be distributed, utilized, and governed).

Build a Community

Attract and engage a community of members who share your vision.

Launch and Iterate

Deploy the smart contracts, issue the tokens, and initiate the DAO. Be prepared to iterate and adapt the governance model based on community feedback.

Expert Insight: "The most successful DAOs are those that prioritize community engagement from the outset. Foster a culture of inclusivity, transparency, and collaboration."

Strategic Alternatives & Adaptations

DAOs aren't one-size-fits-all. Different models are suitable for diverse needs:

- For Beginners: Start with a simple DAO, focusing on clear goals and straightforward governance. Use readily available DAO creation platforms.

- Intermediate Optimization: Experiment with complex governance models such as quadratic voting.

- Expert Scaling: Integrate DAOs within complex decentralized ecosystems and explore complex treasury management strategies.

Validated Case Studies & Real-World Application

Consider the success of MakerDAO, a decentralized lending platform. Its governance structure, driven by token holders, has proven remarkably resilient and responsive to market fluctuations, showcasing the power of a decentralized community in action.

Risk Mitigation: Common Errors

Avoid these common pitfalls:

- Lack of Clear Purpose: Define your mission. Without a clear objective, DAOs may lack purpose.

- Poor Governance: Set out clear voting systems and processes.

- Ineffective Communication: Build up a communication strategy and establish a way to inform members of changes.

Performance Optimization & Best Practices

To maximize your DAO's performance:

- Cultivate an Active Community: The success of your DAO relies on its community participation.

- Regularly Review and Adapt: Governance models should evolve.

- Prioritize Security: Implement rigorous security audits and protocols.

Scalability & Longevity Strategy

Sustaining long-term success requires proactive planning. Build a robust treasury, develop a sustainable tokenomics model, and focus on empowering your community through education and opportunities. Adapt to change and remain open to market trends.

Knowledge Enhancement FAQs

What is a DAO and how does it work?

A DAO is a decentralized autonomous organization that operates on blockchain technology. It uses smart contracts to automate decision-making, ensuring transparency and community governance.What are the benefits of DAOs?

They offer increased transparency, efficiency, community control, and the potential for fairer and more equitable organizational structures.How do DAOs make money?

DAOs can generate revenue through fees, token sales, fundraising, or providing services.How do I participate in a DAO?

You typically acquire DAO tokens and participate in voting.